Esg for Dummies

Wiki Article

3 Simple Techniques For Esg Investing

Table of ContentsEsg Sustainability for DummiesThe Greatest Guide To EsgAbout Esg SustainabilityLittle Known Questions About Esg.

Why do specific investments carry out much better than others? Why do certain startups appear to always outmatch and also prosper of the cohort? The response has 3 letters, and also it is Whether you are a capitalist or a firm, large or little - Environmental, Social and also Administration (ESG) reporting and also investing, is the framework to capture on if you wish to keep up to speed with the marketplace (and also your bill) - ESG Sustainability.Currently, let's study the ESG topic and the wonderful importance that it has for business and capitalists. To assist financiers, economic institutions, and also companies understand far better the underlying criteria to execute and report on them, we made a. Download the form below and also access this unique ESG source absolutely free.

The method of ESG spending started in the 1960s. ESG investing developed from socially liable investing (SRI), which left out supplies or entire industries from investments related to service procedures such as tobacco, guns, or products from conflicted areas.

Components of it are efficient from March 2021. The objective is to reorient funding flows in the direction of lasting financial investment and away from fields adding to climate change, such as fossil fuels.: is arguably the most enthusiastic message aiming to give a non-financial total score covering all facets of sustainability, from ESG to biodiversity and also air pollution treatment.

3 Easy Facts About Esg Investing Described

You rather jump on this train if you do not desire to be left behind. There is a boosting recognition that. For firms to remain in advance of regulations, competitors and also unleash all the advantages of ESG, they should integrate this structure at the core of their DNA. In an additional viewpoint, to take care of regulative, legal or credibility problems at a later stage.

(ESG) concerns are playing an increasing function in companies' decisions around mergings, procurements, and also divestitures. However just how do these aspects link to company efficiency and also deal potential? In this episode of the Inside the Approach Space podcast, 2 experts share their insights on navigating this fast-changing landscape. Sara Bernow, that leads Mc, Kinsey's work in sustainable investing and also co-leads the institutional investing method in Europe, is a co-author of the current article, "More than values: The values-based sustainability reporting that financiers want." Robin Nuttall leads our governing as well as government affairs method as well as lately co-authored "5 manner ins which ESG produces worth." They consulted with Technique & Corporate Money communications supervisor Sean Brown at the European 2020 M&A Meeting in London, which was organized by Mc, Kinsey and Goldman Sachs.

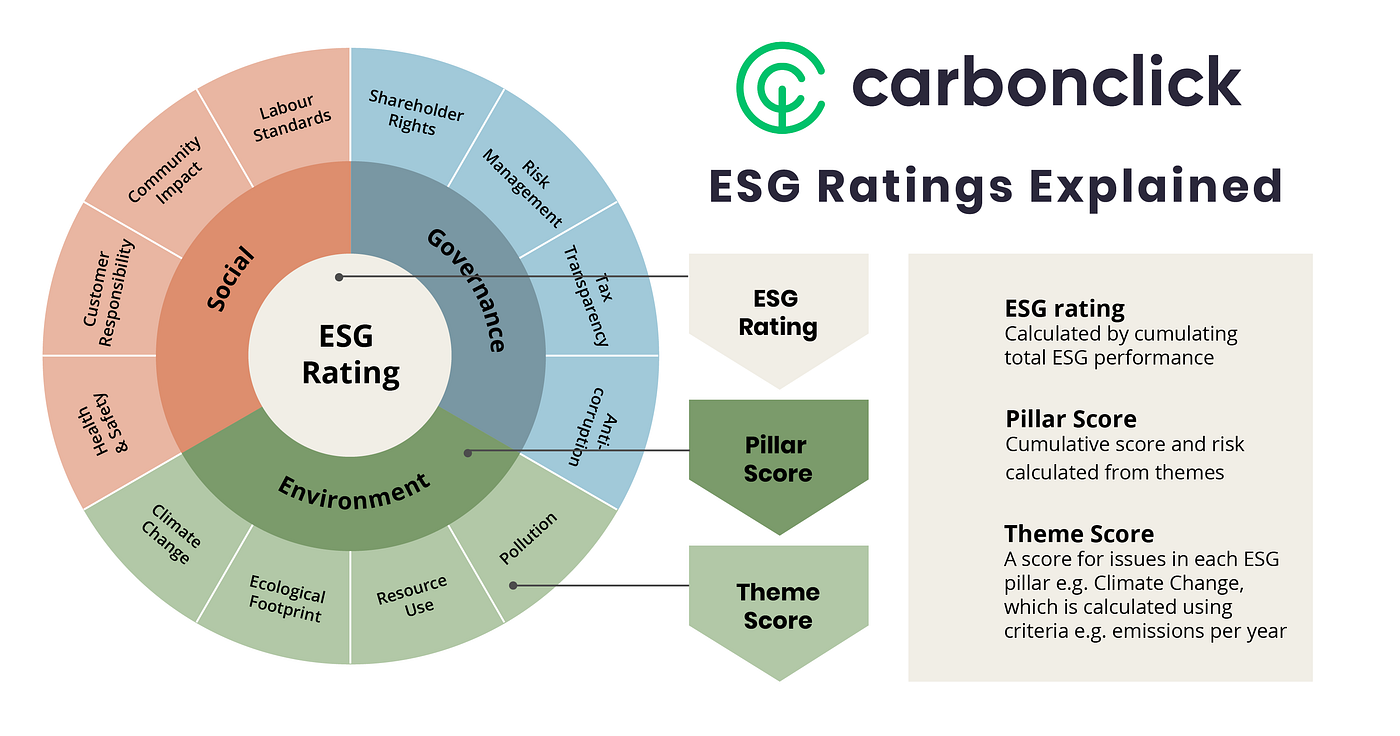

For even more conversations on the method problems that matter, subscribe to the collection on Apple Podcasts or Google Play - ESG Investing. Audio Why ESG is here to stay Sara, could you begin by describing what ESG is and why it has increased in importance in M&A? ESG is fairly a broad Discover More Here set of issues, from the co2 impact to labor techniques to corruption.

Some Known Factual Statements About Esg Sustainability

They link together in the feeling that the atmosphere, the social aspects, as well as the degree to which you have great governance affect your license to operate as a company within the outside globe. To what level do you manage your ecological impact? That has an impact on your license to operate in the minds of the stakeholders around you: regulators, governments, and also significantly, NGOs powered by social media.Consumers are currently demanding high criteria of sustainability and quality of employment from businesses. Regulatory authorities as well as policy manufacturers are much more thinking about ESG because they require the company sector to assist them resolve social troubles such as environmental pollution as well as workplace variety (ESG Technology). basics The investor community has actually additionally come to be a lot more interested.

Insight/2019/09.2019/09.26.2019_WealthESG/Socially%20responsible%20investing%20by%20age%20group.png)

Taking an industry-by-industry lens is critical as well as we now see ESG-scoring agencies building deeper industry-specific point of views. What are several of the crucial elements on which ESG ratings have an effect? The first question you require to respond to is, to what degree does good ESG equate right into good economic efficiency? On that, there have been more than 2,000 academic research studies and around 70 percent of them find a favorable relationship between ESG ratings on the one hand and also financial returns on the other, whether measured by equity returns or success or evaluation multiples.

How Esg Technology can Save You Time, Stress, and Money.

Proof is arising that a much better ESG score translates to regarding a 10 percent reduced cost of capital as the risks that impact your business, in terms of its license to operate, are decreased if you have a solid ESG recommendation. Evidence is arising that a much better ESG score translates to regarding a 10 percent lower price of resources, as the dangers that influence link your service are reduced.Report this wiki page